Buying life insurance can be challenging sometimes. There are certainly a lot of different policies on the market. Which one fits your needs and budget for starters. Insurance companies have different requirements for qualifying for particular policies they may offer. The 9.95 insurance plan from Colonial Penn is a staple of no health question life insurance.

For some life insurance consumers, the familiarity with an insurance company name creates a sense of trust. However, be aware when you purchase life insurance, it is best to know what is specifically written in the policy. Ignore the name of the insurer. Apples are not apples here and it really has little to do with the name of the insurance company. Reading Colonial Penn $9.95 plan reviews are a good place to find out what their advertisement is not clearly explaining to you. Remember you are purchasing a policy that defines how your family will be compensated when you pass away.

What is the 995 plan all about? Below you will find our professional and experienced based review of this Colonial Penn product. You can be assured as a licensed and independent life insurance agency, that we are speaking not only from extensive life insurance education and training but actual experience working with life insurance consumers daily age 50-90.

The Colonial Penn $9.95 Commercial With Jonathan Lawson

If you’ve seen the many Colonial Penn ads over the years, then you know they like to use paid endorsers to market their life insurance to people 50-85. The latest Colonial Penn commercial is revitalizing their guaranteed acceptance whole life insurance with a new marketing approach. The difference, Jonathan Lawson… an official employee of Colonial Penn. This of course is unlike paid endorsers like Alex Trebek or Ed McMahon.

In this review, we are going to break this down for you so you can see the pro’s and the con’s and how it’s really priced and would perform for a consumer that purchased it. We are going to provide feedback from the many people who call us weekly and give us their Colonial Penn life insurance “customer reviews” so to speak.

Colonial Penn $9.95 Life Insurance

Colonial Penn, with Jonathan Lawson’s assistance have rebranded the insurance company’s Guaranteed Acceptance Whole Life insurance as of 2022. It now is referred to as the 995 Life Insurance Plan with more focus on a number than ever before. Unfortunately, consumers are frequently upset to learn that $9.95 per month buys very little life insurance and certainly not enough to cover the cost of anyone’s funeral and burial age 50-85.

What Is The 9.95 Life Insurance Plan

First point to write down. A whole life insurance policy will not expire or lose value as you age, even with deteriorating health. However, the 9.95 life insurance just a subtype of whole life insurance. This insurance plan includes “Guaranteed Acceptance” which means if you meet the age requirements at application time, you will not be denied coverage. Anyone between the ages of 50-85 may purchase lifetime coverage on this plan from Colonial Penn.

Guaranteed Acceptance and what does that mean?

There are NO health questions. For

That sounds pretty good right?

Not so fast. The reality…

It will cost you a pretty penny to own upfront and risk your family not receiving the policy value you purchased. More on this later.

Second, you will not have full benefits for the first 2 years for natural causes of death.

You must understand that life insurance companies cannot evaluate the risk of an applicant accurately without asking health questions. Life insurance is traditionally, medically underwritten allowing the carrier to accurately assess their applicants overall insurability.

What do you think an insurance company does to offset the risk of not having a clear picture of who is requesting burial insurance protection like the Colonial Penn 9.95 Plan?

You got it. They jack those rates up for starters…

And…

They also insert a 2 year limited benefit period for natural death causes into the policy. They have now “modified” the whole life insurance to protect their perceived risk.

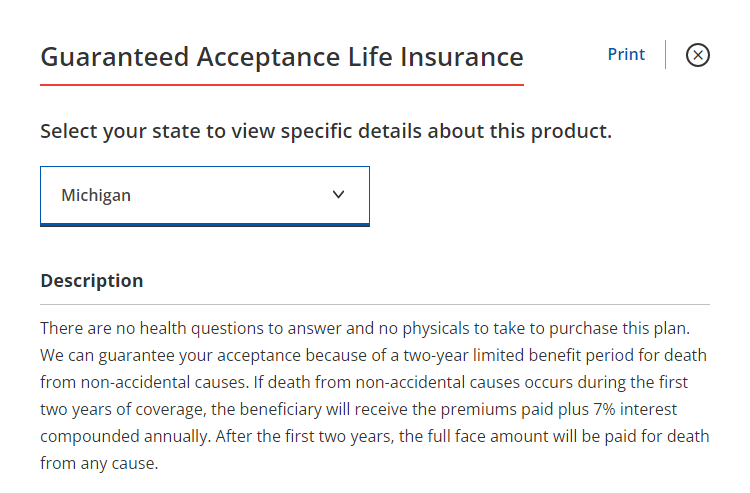

It might be hard to believe that Jonathan Lawson Colonial Penn life insurance is like this, so I took the following from the Colonial Penn website. Please be sure to carefully read the description below. This is the reality of what your family would be stuck with.

Here is what you need to understand about that.

For the first 2 years of coverage with the Colonial Penn, 9.95 life insurance plan, your loved ones do not have much natural death protection. For example: cancer, stroke, heart attack, etc. Further, the interest rate factor offered is not competitive with the top life insurance companies offering guaranteed acceptance policies either.

Now, if you perish due to an accident such as a car wreck or a slip and fall, Colonial Penn would be obligated to pay the full policy amount as long as your passing occured within 90 days of the accident.

How Much Coverage Is The $9.95 Plan?

The Colonial Penn $9.95 per month plan is priced in “units.” What is a unit then? With Colonial Penn’s guaranteed acceptance whole life, a unit is a predetermined amount of insurance that you pay for based on your age at application and your first payment is made. Each unit will cost you $9.95 per month regardless of age.

How much of a death benefit is included per unit with the Colonial Penn $9.95 plan? Well, this will again, depend upon your age but also your gender. Assuming the insured lives more than 2 years, it could be as little as a few hundred dollars per unit or up to a couple thousand. Youth is an asset when buying a life insurance policy, always. Colonial Penn is no exception. It is not clearly expressed, unfortunately.

Each unit’s value is determined by your age when you apply and is locked in for the life of the policy. As long as you keep paying on the policy, the cost will never increase. The younger you are at application, the higher the value of each unit.

So how many units of the Colonial Penn 995 per month plan can a consumer buy? In January 2023, 15 units is the maximum. This means premiums for anyone applying will not exceed $149.25/month ($9.95 x 15). However, that does not mean the product is affordable or priced well. Take a look at the chart below. See the value of insurance protection per 1 unit.

We suggest using our instant quoting tool on this page so you can see how much life insurance $149.25/mo will buy you with the top life insurance carriers versus Colonial Penn.

Colonial Penn 995 Plan Rate Chart By Age

| Age | 1 Male Per Unit ($9.95) | 1 Female Per Unit ($9.95) |

| 50 | $1669 | $2000 |

| 51 | $1620 | $1942 |

| 52 | $1565 | $1890 |

| 53 | $1515 | $1845 |

| 54 | $1460 | $1802 |

| 55 | $1420 | $1761 |

| 56 | $1370 | $1719 |

| 57 | $1313 | $1669 |

| 58 | $1258 | $1620 |

| 59 | $1200 | $1565 |

| 60 | $1167 | $1515 |

| 61 | $1112 | $1460 |

| 62 | $1057 | $1420 |

| 63 | $1000 | $1370 |

| 64 | $949 | $1313 |

| 65 | $896 | $1258 |

| 66 | $846 | $1200 |

| 67 | $802 | $1167 |

| 68 | $762 | $1112 |

| 69 | $724 | $1057 |

| 70 | $689 | $1000 |

| 71 | $657 | $949 |

| 72 | $627 | $896 |

| 73 | $608 | $846 |

| 74 | $578 | $802 |

| 75 | $549 | $762 |

| 76 | $521 | $724 |

| 77 | $503 | $689 |

| 78 | $493 | $657 |

| 79 | $441 | $627 |

| 80 | $426 | $608 |

| 81 | $424 | $578 |

| 82 | $423 | $549 |

| 83 | $421 | $521 |

| 84 | $420 | $493 |

| 85 | $418 | $468 |

Colonial Penn life insurance is not priced per thousand dollars in the manner the top life insurance companies use. While the advertisement seems to say how “affordable” the coverage is, the reality is quite different. This is simply because $9.95 just does not buy much insurance protection for the vast majority of people. Colonial Penn 9.95 life insurance is just very expensive to own. As a buyer, you will likely need to purchase more “units” to get adequate coverage to meet your needs particularily if applying in your 70’s and 80’s.

Colonial Penn $9.95 Life Insurance Plan Pro’s

- No Health Questions and No Medical Exam

- Very small policy amounts available

- Guaranteed Lifetime coverage and level premiums

Colonial Penn 995 Life Insurance Plan Con’s

- Very high in cost

- 2 year limited benefit clause for natural death

- Low maximum policy value for those applicants in their later senior years

- Puts family at risk of not receiving the money they need for funeral and burial costs for 2 full years

- May not provide adequate death benefits for a funeral and burial due to maximum policy size

Male Rate (AGE 64) For Guaranteed Acceptance Whole Life Insurance Compared to Colonial Penn’s 995 Plan

Female Rates (AGE 64) For Guaranteed Acceptance Whole Life Insurance Compared to Colonial Penn’s 995 Plan

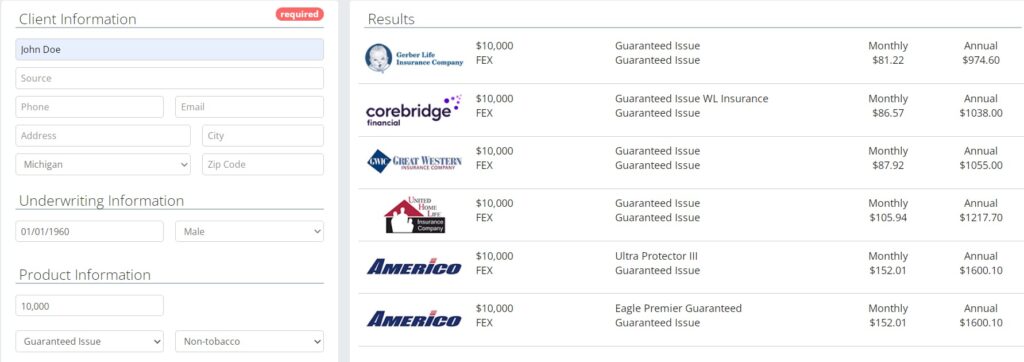

With the Colonial Penn 9.95 Plan, 10 units for a 64 year old male would produce a max death benefit value of $9490. Total monthly premiums would be $99.50 (9.95 x 10) per month for the remainder of the insureds life.

In the comparison quote above, we can see that there are competitors that offer Guaranteed Issue whole life insurance for a much more competitive price. For example, we see Gerber Life offering the same no medical question, no exam life coverage for $81.22 for a full $10,000 of coverage. Without getting into the details, during the 2 year limited benefit period, it does offer better benefits as well. As you can see, there are clearly 3 companies that are considerably more affordable for Guaranteed Acceptance whole life insurance.

Looking at a fair comparison for a 64 year old female to have almost $10,000 in coverage with Colonial Penn would require a purchase of 7 units. 7 units would buy $9191 death benefit coverage which results in a monthly premium of $69.65 (9.95×7).

A $10K policy with Gerber Life would be $61.05 in comparison for the same, no health question, no exam, whole life insurance. The Gerber benefits for the first two years are also better than the Colonial Penn 995 plan and beyond the scope of this review.

Tips For Finding The Best Burial Insurance Policy

Whether it’s Ed McMahon, Alex Trebek or a real a real CP employee like Jonathan Lawson, don’t let the commercial fool you into believing the Colonial Penn 995 per month policy itself is something special.

lt is just fancy TV sparkle to fool you into buying overpriced final expense life insurance.

You can save a lot of money by purchasing the right no exam policy that really benefits your family and saves a lot of your hard earned money. No one wants to overpay on their insurance or leave their family short of resources do to policy limitations. Most people will qualify for full, first day benefits and much lower pricing than I have quoted above.

As I see it, you really have a couple choices as you make your life insurance decision.

- Buy life insurance directly from certain insurance companies (ie: Colonial Penn, AARP/NYL, Globe Life, State Farm etc.) and get overcharged or substandard policy.

- Find a state licensed independent life insurance agent/broker that represents a lot of different life insurance companies. Have them shop for your best options.

One of the biggest consumer mistakes is assuming that you get a good deal when “buying direct” from a carrier.

This is incorrect and gets the consumer ripped off most of the time, sold a low grade policy or worse, declined.

Why?

Number one, you are limiting your options. Apples are not apples with life insurance. Many insurance companies simply don’t offer a good life insurance policy. Does not matter if it’s term, whole or even universal life. Buy the policy/plan, not the advertisement or name of the insurance company. Secondly, you’ve raised the likelihood of being declined if your health is not ideal or up to their standards. Number three: Insurance companies outside of “direct” companies are much more competitive. This leads to lower premiums, better policies for your $ and better protection for those you love.

These “direct” companies will NOT advise you to obtain coverage from another insurance company who has a better policy and lower price. Yes, they are happy to overcharge you each month. Imagine years of overpaying premiums to keep the protection locked in.

When you work with an agent or agency that brokers all the top life insurance companies, you have an excellent chance at getting the best policy for your needs and at a good price. This is even true if you believe your health is not so good.

At Maple Valley Insurance Group, we work with carriers who do offer affordable first day, lifetime coverage… even for people with tough medical conditions like CHF, daily oxygen use, COPD, kidney dialysis (must be under doctors care) and a host of other health issues.

If you want the best burial insurance, it is best to avoid the 9.95 plan from Colonial Penn. Very, very few people need this type of life insurance policy and are grossly overpaying.

Have your independent agent go shopping for you. No longer do you have to accept higher premiums and lower benefits just because your health is not A1. No exam life insurance isn’t hard to find if you are talking to the right people. If you want the full scoop on burial insurance for seniors be sure to talk with an independent and experienced broker.

Colonial Penn would like you to think they are a cut above the rest. This is clearly not the case.

Negative Colonial Penn Reviews Including The $9.95 Life Insurance Plan

Colonial Penn does have a high NAIC Complaint Ratio. Lots of upset people out there who were not satisfied with their Colonial Penn experience. This does not mean that Colonial Penn was denying legitimate claims but it sure seems as though many families have felt mislead in regards to the coverage they or their family member purchased.

This is not good folks. According to the NAIC (National Association of Insurance Commissioners), in 2022, they had over 4X times as many complaints against it versus other insurance companies similar to its size. This is well above the industry average.

When you buy life insurance, you want to make sure you are dealing with an agent/broker who is able to tell you the pro’s and the con’s of any policy your are considering. Colonial Penn is selling “direct” to you. You are not going to get expert advice calling a captive company’s call center.

Don’t get caught in the gimmicks. This seems to be a problem for consumers buying into Colonial Penn’s marketing. I suspect this the source of most of the complaints from policyholders or their beneficiaries.

I checked a major consumer review site of Colonial Penn, Yelp in Philadelphia. You can see why the NAIC is having lots of complaints filed against this insurer. Yelp users seems to be pretty ticked off to say the very least. Take a look for yourself.

More often than not, when I receive a phone call from someone angry with Colonial Penn, I find out that the policy purchased was not explained properly by the salesperson who sold it. You could say I hear many negative customer reviews of Colonial Penn insurance each year.

And, in those Colonial Penn negative reviews, the trend is pretty standard. Just to be clear, these folks are not angry with Maple Valley Insurance Group. We do not offer any Colonial Penn products here. These are just life insurance consumers looking for better and more affordable life insurance than Colonial Penn sold them. Many people I’ve spoken to feel very misled by Colonial Penn.

I can see why.

The Colonial Penn $9.95 plan puts your family member at risk during the first 2 years even with the high price attached to it.

Going to say it again here, most people 50-85 can do a lot better than a guaranteed acceptance policy. Why put your family at risk when you are paying top dollar for the coverage? Talk to an expert or just start with a quote from our instant quote tool on this page.

When you buy a policy, be sure to read it over to be sure it meets your expectations. Ask your life insurance advisor to clarify any questions. If it does not meet your satisfaction, consider exercising your free look provision which will allow you a full refund in most states. The free look period is 20-30 days depending upon your state’s law.

If you ultimately need to file a complaint against an insurance company, what can you do?

Well, you can enter your grievance with a company called Complaints Board. They have helped consumers since 2004 resolve conflicts with lots of different companies, not just insurance carriers. Your second option is to call your State Department of Insurance and file an official complaint against the insurer. Most insurance companies do not want to be “investigated” and will respond to the investigation quickly.

Conclusion: Is the Colonial Penn 9.95 Per Month Insurance Plan Really Worth It?

The Colonial Penn Jonathan Lawson commerical simply sounds like a top of the line life insurance policy doesn’t it? The familiarity of the “Colonial Penn” name brings a false sense of security with it. There is also the association with the late Alex Trebek the famous Jeopardy host but also a paid endorser of the Colonial Penn 9.95 life insurance plan assuming it must be something special.

Unfortunately, it is actually quite the opposite. Despite what is being verbalized to you, the plan is not worth buying. What is written in any guaranteed acceptance whole life plan is what your loved ones will receive, nothing more.

How much coverage does the 9.95 plan give you is not the keyquestion to ask. Instead, I suggest asking: what are the limitations of the policy I am prequalified for, followed by how much would 10, 15, 20, 30, 50K etc cost me each month.

Is The Colonial Penn 995 Per Month Plan A Scam Then?

No, I do not believe Colonial Penn is scamming anyone by selling guaranteed acceptance whole life insurance. In a few cases out of 100, it is necessary. For those individuals in very high risk catagories, it may be the only type of life insurance that will be available. In the comparison quotes above I showed you a few carriers who offer the same policy type with their company but these products are purchased through independent agents/brokers instead. Oddly enough, the competitors have below average complaint levels.

With all of that said, I do believe Colonial Penn life insurance marketing is rather deceptive as it does not follow industry standards among other “questionable” sales tactics. Make sure you are talking with a expert that knows their “stuff” and treats you with courtesy. You should be told all the positives and the negatives of owning a particular life insurance policy.

Reading Colonial Penn Reviews, you’ve probably started to wonder if there really is something to really be concerned about.

Is The 995 Plan Any Good?

Compared to the majority of whole life policies on the market, no. It just does not have the benefits offered in premium whole life insurance policies and is expensive to boot.

They key to really understanding the previous statement…

There are really 3 tiers of no exam, whole life insurance plans on the market. Yes, the pricing varies on each tier from company to company. With that said, the top tier offers the lowest premiums and full immediate benefits. Most people age 50-85 qualify for this no exam policy by just answering a few “yes or no” health history questions. That is a fact. You can get instant quotes for the top companies and policies on the market with our Final Expense Insurance tool. Without going into the different tiers any further, Guaranteed Acceptance Whole life insurance is at the bottom. That is what the 995 life insurance is all about.

In exchange for asking you absolutely no health history questions, “guaranteed acceptance” means lower benefits and higher prices. An insured individual on this type of insurance is considered a high risk life insurance candidate.

Ladies and gentleman, there are thousands of different insurance carriers across the country. Many of them are life insurance companies. Colonial Penn is just 1. The vast majority of the top life insurance companies market themselves directly to independent life insurance agents/brokers not consumers. They do not sell “direct” to consumers and ironically, don’t seem to have all the complaints that Colonial Penn seems to have.

There is a reason Colonial Penn works the way it does. They don’t want to compete against the other “horses in the stable” based on real value and competitive pricing.

They have mastered the illusion of a wonderful, affordable policy with “guaranteed acceptance.” Their advertising drives callers 50-85 to pick up the phone and buy on emotion rather than doing research like you.

Colonial Penn needs to go back to the drawing board and create more affordable final expense products with better benefits. While they are “making improvements, upgrade their sales and service side of the company. As a company, they just don’t offer value compared to the top final expense insurance companies.

Protecting your family is very important and commendable. Final expense life insurance can protect your loved ones. Just realize that you are compromising when working with any single insurance company like Colonial Penn. Positive, professional reviews of the Colonial Penn Life $9.95 per month plan are hard to find. The policy itself, has limited use, unless you are over age 80 and in very poor health for your age. You can do much better 90% of the time. If you are 81-85 and have a grim health outlook such as terminal illness or kidney failure…well the 995 guaranteed acceptance plan may be your only alternative to obtain any life insurance.

And that is that.

How many Colonial Penn $9.95 plan reviews have you read at this point? You’ve probably found plenty of customer reviews about Colonial Penn life insurance that were not positive at all. Are you ready to take the next step forward to protect your love ones? Do you want expert guidance, great service and peace of mind? We’ll be here to answer any questions and/or get your family protected, affordably. Consultation and help is always free here. 269-244-3420

Feel free to comment below if you feel motivated to do so.